capital gains tax canada inheritance

Capital gains tax in Canada on inheritance. That means youll theoretically owe capital gains tax on the difference between the value of the inherited home and the FMV of the home when you chose to start renting it out.

Capital Gains Taxes And More The Implications Of Inheriting Real Estate Moneysense

She bought stocks at the beginning of.

. For example if you. Therefore the LCGE allows you to exempt a certain amount of these gains from taxation. There is no inheritance tax in Canada but the estate will still need to pay taxes that the deceased owes.

Carry back a net capital loss to reduce any taxable gains in any of the three years prior to the year of. The tax rate for capital gains is as low as 0 percent and as high as 37 percent based on your income and whether the asset was a short-term or long-term investment. Therefore upon the parents death property of 80000 is inherited with perhaps 7600 maximum due for inheritance taxes and probate fees there are still no transfer taxes.

There are no federal inheritance taxes and only six states levy any form of inheritance tax. The tax may not feel. To be eligible you need.

Find out more about final returns inheriting property and more. Calculates your capital gains tax when you sell property or stocks based on the province you live in. In Canada the estate of the deceased will pay capital gains tax on any accrued gains as of the.

There are two ways to apply a net capital loss incurred in the year of death. If you sell your inherited property and rent it. This means that you would owe capital gains taxes on the 75000 increase in capital.

If you bought a cottage for 200000 and now sell it for 500000 you will receive 300000 in capital gains and 150000 in taxes. Canada does not impose an inheritance tax on the recipient of the inheritance. When you buy a home you must pay tax on its fair market value at the time of purchase.

To have been a resident of Canada for at least part of 2021. Capital gains tax arises when you incur a. Currently the value of an estate above which inheritance tax is paid is 325000 in.

Given the state-specific nature of inheritance taxes this subject is beyond the. The tax basis of an asset is the value thats used to calculate the taxable gainor losswhen the asset is sold. In Canada there is no inheritance tax or death tax so there is no need to pay it.

As there is no inheritance tax in Canada all income earned by the deceased is taxed on a final return. While there is no. It is possible that the grantor will pay capital gains tax on the disposition of the assets though.

Usually the tax basis is the price the owner paid for the asset. Line 12700 - Taxable capital gains. Non-registered capital assets are considered to have been sold for fair.

When you inherited it it had a value of 125000. When a person dies in Canada taxes are owed too. Shares funds and other units.

There is no gift tax in Canada so living inheritances are not taxed. Property you inherit or receive as a. A capital gain is a profit you make when you sell something youve had in your posession or for your own use.

Lets take a moment to understand what capital gains tax is. Inheritance tax is calculated on the value left in the estate once all of these are settled. In Canada all taxpayers are subject to capital gains taxes when they dispose of property.

If you choose not to or cannot pay this. The dead are said to have received the.

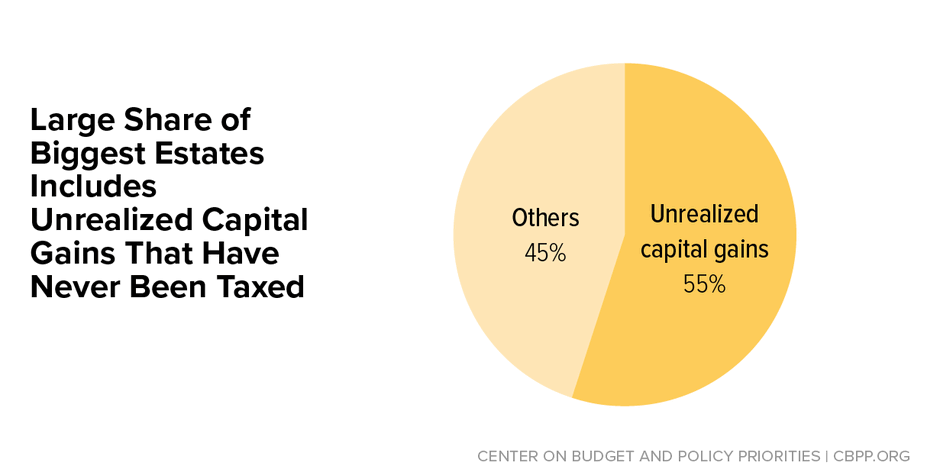

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Is There Such Thing As Estate And Inheritance Tax In Canada Retire Happy

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Inheriting From The United States While Living Abroad

Do You Pay Capital Gains Taxes On Property You Inherit

How To Sell Inherited Property In California Without Hassle

Capital Gains Tax Rate Rules In Canada What You Need To Know

Five Basics To Know About Inheritance Taxes Wealth Professional

How To Avoid Paying Capital Gains Tax On Inherited Property

Do I Have To Pay Taxes When I Inherit Money

How Inheriting A House Works In Canada

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

What Is The Cost Basis Of Inherited Stock Chase Com

Must U S Permanent Resident Report Inheritance From Canadian Bankrate Com

Opportunities And Pitfalls For Foreign Inheritances And Beneficiaries Advisor S Edge

Canadian Inheritance Tax Laws And Information Filing Taxes

Inheriting A Secondary Residence Some Planning May Be Required Sfl Wealth Management Sfl Investments